the Course of a Tender Offer and Related Legal Proceedings

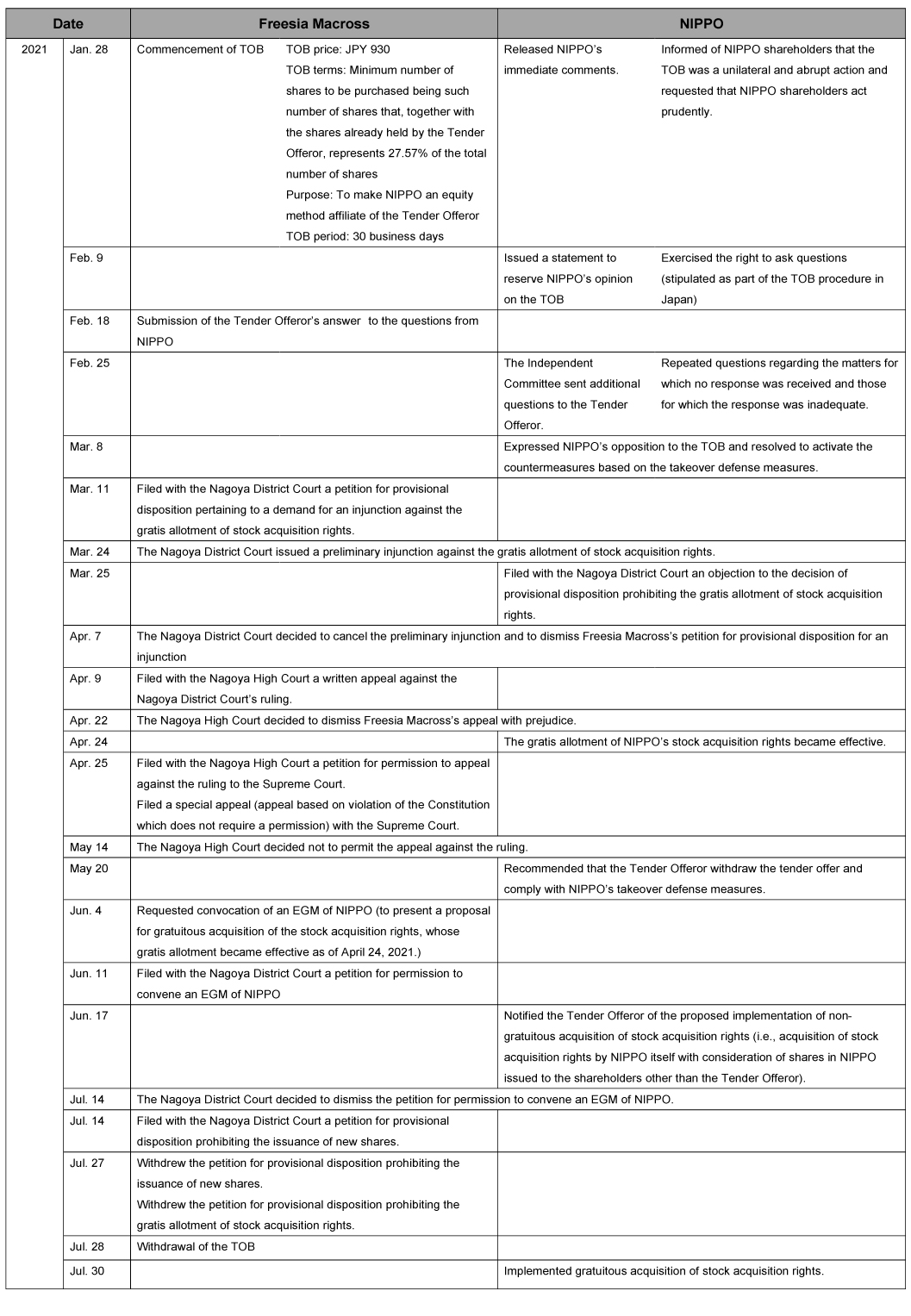

Below please find a summary of the course of a tender offer (the “Tender Offer” or the “TOB”) for the stock of NIPPO LTD. (“NIPPO” or the “Company”) commenced on January 28, 2021 by Freesia Macross Corporation (“Freesia Macross” or the “Tender Offeror”), and related legal proceedings.

The Tender Offer was initiated by Freesia Macross without following the procedures required of a large-scale purchaser under the pre-warning takeover defense measures established by the Company. The Company carefully evaluated and examined the content of the Tender Offer from the viewpoint of securing and enhancing corporate value of the Company and common interests of its shareholders by asking the Tender Offeror certain questions during the procedures for the Tender Offer and other means. As a result, at the meeting of the board of directors held on March 8, 2021, based on

(a) the Tender Offer and the establishment of a capital and business alliance with the Tender Offeror likely to cause a deterioration

in the relationships with the Company’s customers, suppliers and financial institutions and, in turn, highly likely to impair

the corporate value of the Company and harm the common interests of its shareholders,

(b) the business synergies proposed by the Tender Offeror likely to have a minimal and rather negative impact,

(c) the Tender Offer disregarding the intentions of the Company’s shareholders and disrespecting the interests of

the Company’s minority shareholders, and

(d) the fact that it would be impossible to build a relationship of trust between the Tender Offeror and the Company

as partners of a business alliance,

the Company resolved to oppose the Tender Offer and, taking into account the recommendation of the Independent Committee consisting of members including independent outside directors, resolved to make the gratis allotment of stock acquisition rights (based on which shares of the Company could be issued to shareholders other than the Tender Offeror for the acquisition by the Company itself of the stock acquisition rights, thereby diluting the acquirer's shareholding ratio) as an activation of countermeasures based on the pre-warning takeover defense measures. The Company implemented the gratuitous acquisition of all of such stock acquisition rights after the Tender Offeror withdrew the petition for provisional disposition prohibiting the gratis allotment of stock acquisition rights and the petition for provisional disposition prohibiting the issuance of new shares (as mentioned below) as well as the Tender Offer.

Petition for provisional disposition pertaining to a demand for injunction against the gratis allotment of stock acquisition rights

Against the countermeasures activated by the Company as mentioned above, on March 11, 2021, Freesia Macross filed a petition with the Nagoya District Court for provisional disposition prohibiting the gratis allotment of stock acquisition rights. The Company argued that these petitions were completely groundless and obtained a rulings dismissing the Freesia Macross petition at the Nagoya District Court and the Nagoya High Court. Freesia Macross then appealed to the Supreme Court, but on July 27, 2021, the Company was notified that Freesia Macross had withdrawn these petitions.

Petition for permission to convene an extraordinary general meeting of shareholders (“EGM”)

On June 4, 2021, the Company received from Freesia Macross a request to convene an EGM to present a proposal to require the board of directors to acquire stock acquisition rights without consideration (i.e., acquisition by the company itself of stock acquisition rights equally without consideration from all the shareholders, including shareholders other than the Tender Offeror). The board of directors of the Company resolved at its meeting held on June 16, 2021 not to comply with the request for convocation of an EGM because the Companies Act does not entitle anyone to request an EGM to present such a proposal, and the articles of incorporation of the Company do not contain any provisions enabling such a proposal to be resolved at a shareholders’ meeting. The Company replied to Freesia Macross to that effect. On June 11, 2021, Freesia Macross filed a petition with the Nagoya District Court for permission to convene an EGM for such proposal. On July 14, 2021, the Nagoya District Court rendered a ruling to dismiss the petition.

Petition for provisional disposition pertaining to a demand an injunction against the issuance of new shares

On July 14, 2021, Freesia Macross filed a petition with the Nagoya District Court for provisional disposition prohibiting the issuance of new shares (i.e., issuance of new shares as the consideration of acquisition of the stock acquisition rights issued as the activation of countermeasures based on the pre-warning takeover defense measure, etc.). On July 27, 2021, the Nagoya District Court notified the Company that Freesia Macross had withdrawn its petition for provisional disposition prohibiting the Company from issuing new shares.

【Course of TOB and Legal Proceedings】

In addition to the above mentioned Tender Offer and legal proceedings in relation to the activation of the countermeasures by the Company, Freesia Macross filed lawsuits in connection with “Proposal No. 4: Continuation of countermeasures to large-scale purchases of the company’s shares (takeover defense measures)” approved by a majority of the votes cast at the 69th Ordinary General Meeting of Shareholders of the Company held on June 24, 2020. Below is a summary of the course of the lawsuits.

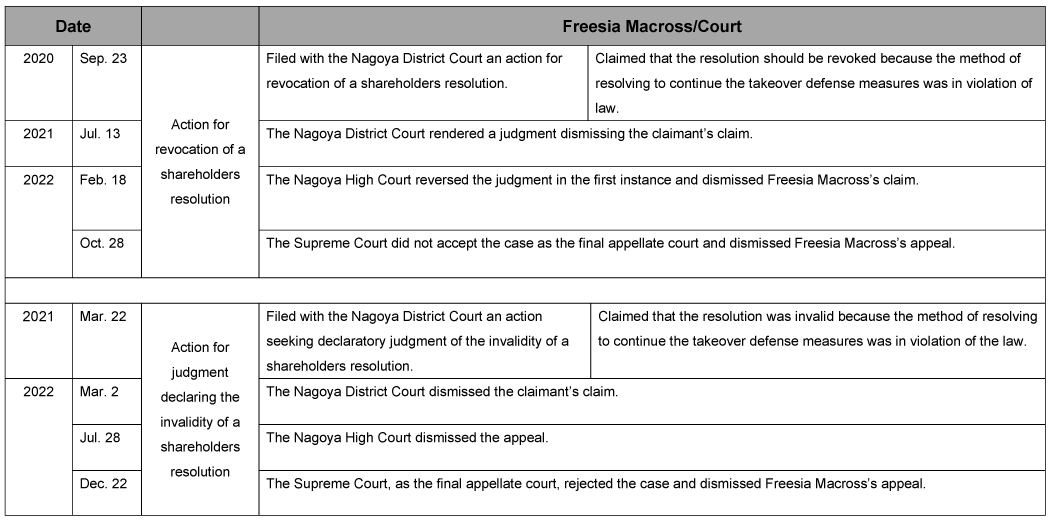

Action seeking revocation of a shareholders resolution

At the 69th Ordinary General Meeting of Shareholders held on June 24, 2020, the Company resolved to approve “Proposal No. 4: Continuation of countermeasures to large-scale purchases of the company’s shares (takeover defense measures).” On September 23, 2020, Freesia Macross, a shareholder of the Company, filed a lawsuit seeking revocation of this resolution, claiming that the method of resolution was in violation of the law. The Company prevailed in the first, second, and final appellate instances, and the judgment became final.

Action seeking declaratory judgment of the invalidity of a shareholders resolution

On February 10, 2021, Freesia Macross filed a lawsuit with the Nagoya District Court seeking declaratory judgment of the invalidity of the resolution approving “Proposal No. 4: Continuation of countermeasures to large-scale purchases of the company’s shares (takeover defense measures)” that had been adopted at the 69th Ordinary General Meeting of Shareholders of the Company held on June 24, 2020, claiming that the content of the resolution was invalid for being in violation of the law. After the Company prevailed in the first, second and final appellate instances, the judgment became final.

【Course of Litigations】